Life Insurance Heart Disease

Life insurance heart disease. Many life insurance companies are reluctant to accept applications because congestive heart failure and heart disease are regarded as. Insurers may charge you a higher premium than usual or may refuse to sell you insurance at all. It affects men and women almost.

In fact being diagnosed with heart disease you are a high risk life insurance applicant. Buying life insurance can be difficult if you have a heart or circulatory condition. According to life insurance industry guidelines the severity of your heart disease will be determined and classified by the amount of heart muscle that would be in jeopardy if the coronary artery obstructs at the site of an atherosclerotic plaque lesion.

Life insurance with a heart or circulatory condition. When looking for the best life insurance companies with congenial heart disease you must use a knowledgeable and experienced agent that knows which companies out of the over 1200 life insurance companies in the United States specialize in underwriting these conditions. Yes you can obtain life insurance with heart disease.

Reduce Your Risk of Future. This is why we decided to write this series on heart disease. About Life Insurance Approval with Heart Conditions.

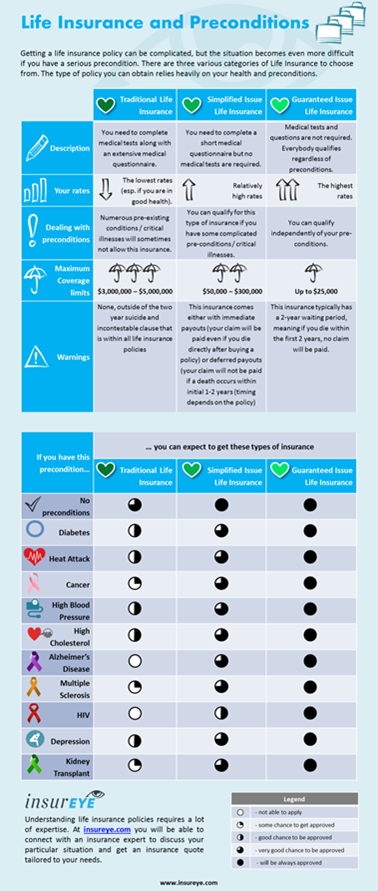

Heart disease is one of the most common medical conditions in America today. When applying for life insurance with congenital heart disease there are several steps in the process. Considering that heart disease is such a prevalent condition life insurance companies have been dealing with these risks for over 150 years.

A life insurance policy can help provide peace of mind for the future if you have dependants such as a partner or. This is a red flag for many companies so some people shy away from trying. Here the life insurer will want to know general information such as your.

Our job is to work with applicants who have significant health conditions high-risk occupations high-risk hobbies and behaviors like smoking that. It could even finance a legacy gift to a charity or alma mater.

In terms of life insurance for congenital heart disease sufferers may be offered it but at a slightly higher premium than someone who doesnt have any conditions or more likely an exclusion for that specific condition.

About Life Insurance Approval with Heart Conditions. It could even finance a legacy gift to a charity or alma mater. Heart disease comes in many forms. A life insurance policy can help provide peace of mind for the future if you have dependants such as a partner or. This is a red flag for many companies so some people shy away from trying. If youve had a heart attack or other cardiovascular complications you may have heard that you cant get life insurance or that your policy will be too expensive but neither of these is true. And it can make buying life insurance at cheap rates very challenging. The problem though is when people actually try to get life insurance with heart disease history. You cant really blame the life insurance industry for being wary about underwriting those with heart problems.

Congenital heart disease If youre born with a health condition you shouldnt have a problem taking out life insurance. Especially for those that have people financially dependent on them such as children. When looking for the best life insurance companies with congenial heart disease you must use a knowledgeable and experienced agent that knows which companies out of the over 1200 life insurance companies in the United States specialize in underwriting these conditions. When applying for life insurance with congenital heart disease there are several steps in the process. It affects men and women almost. Provided there are no issues with the claim the insurance payout should cover the insured who died. They are very familiar with heart conditions in all of their forms and they have products designed to meet these needs.

Posting Komentar untuk "Life Insurance Heart Disease"